Auto Physical Damage: Pricing, Reserving and Current Trends

This blog was researched and written by participants in Pinnacle’s 2024 Pinnacle University development program.

In recent years, the automobile physical damage (APD) insurance market has been subject to changes that have caused premium increases for customers. For our Pinnacle University 2024 presentation, our team focused on researching the drivers behind those increases.

Briefly, APD covers damage to vehicles from car accidents and other causes. There are three different types of APD coverage: collision, comprehensive and combined additional coverage. Together, these cover physical contact with another vehicle, weather events and theft. It is important to note that APD can sometimes be confused with auto liability coverage. However, the coverages differ because auto liability indemnifies damages to other parties involved, including to the individual and their vehicle.

There are different factors that determine APD pricing, and they can be divided into two main categories:

- Driver-related factors: Driver age, gender, credit score, ZIP code and driving record

- Vehicle-related factors: Vehicle make, model, age and VIN number

APD coverage is a short-tailed line with claims that arise and are paid soon after the policy is issued. Insurance companies rely on salvage and subrogation recoveries to lower the loss amount. Our analysis indicated that the following factors resulted in the most impact on the recent rise of APD coverage costs.

Inflation’s Impact on APD

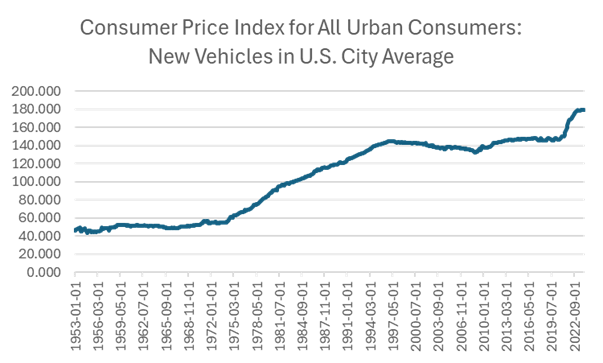

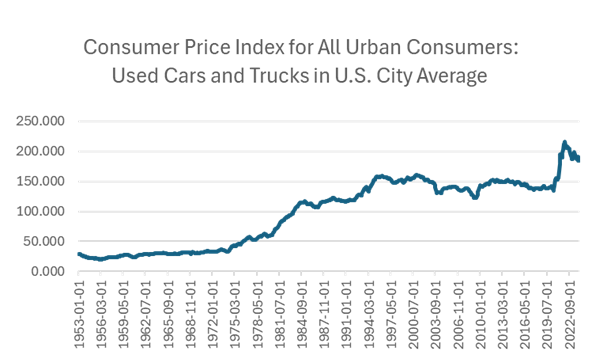

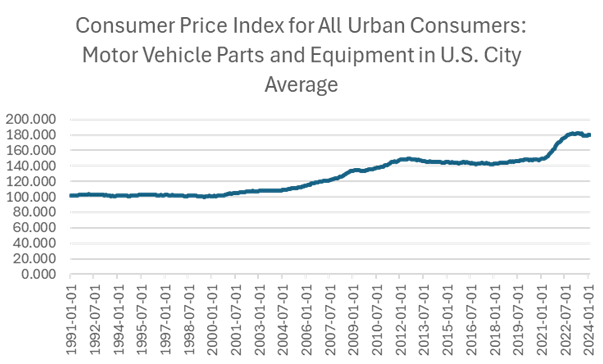

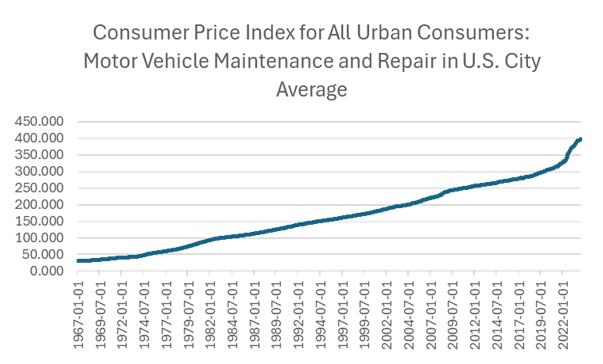

Inflation has indirectly affected the pricing of APD insurance. The recent national rise in the inflation rate has driven up the Consumer Price Index (CPI) of new vehicles, used vehicles, vehicle parts and vehicle repairs. The CPI is a measure of the average change in prices paid by consumers over a period of time. An increase in the CPI indicates an increase in the cost of goods and services.

The above graphs, gathered from the Federal Reserve Economic Data (FRED), illustrate the CPI of new and used vehicles, with both exhibiting increasing trends. Both graphs experienced a significant escalation post-2020, likely related to the COVID-19 pandemic. With further calculation, we found that the percent increase in the CPI for new vehicles from January 2020 to January 2024 was 21.28%. Similarly, the increase for used vehicles within the same time period was 32.08%. That is relevant to the pricing of APD. One important factor in determining cost of APD for a policyholder is the value of the insured vehicle. Consequently, if prices of new and used vehicles increase, so does their value. This increase in value directly affects the cost of APD insurance because higher-valued, damaged cars are more expensive to repair.

The next two graphs, also sourced from FRED, indicate the CPI of vehicle parts and equipment and vehicle maintenance and repair, respectively. We found that the CPI for vehicle parts and equipment increased by 21.61% from January 2020 to January 2024. Similarly, the CPI for vehicle maintenance and repairs rose by 31.95% over the same period. Therefore, the increased cost of repairing vehicles directly impacts the APD premium.

Social Trends

When the COVID-19 pandemic first hit the United States in March 2020, there was an approximately 50% [DT1] decrease in vehicle miles driven compared to miles driven in March 2019 according to the U.S. Department of Transportation Federal Highway Administration. Several insurers responded to this initial decrease in vehicle miles driven by giving insureds credits on their premiums. After the pandemic, vehicles miles driven slowly started to return to normal and, by the summer of 2021, miles driven were about the same as they were prior to the pandemic.

As miles driven have returned to pre-pandemic levels, drivers literally have become more reckless. A report from Cambridge Mobile Telematics, or CMT, found that drivers spend 2 minutes and 12 seconds of every hour interacting with their phones. This is a 23.4% increase since 2020. For every hour of driving, CMT also estimates 2:14 was spent speeding. This is a 7.2% increase since 2020. These increases in driver recklessness are estimated to have caused an additional 420,000 crashes (CMT).

Another social trend impacting APD is a very specific type of theft. An automobile’s catalytic converter is responsible for converting toxic gasses and pollutants from internal [BM2] combustion engine into less toxic pollutants to reduce the harmful emissions produced by the engine.

Catalytic converters are typically made with the precious-metals rhodium, palladium and platinum, which makes them an attractive target for theft, as thieves are able to extract the precious metals and then sell them. An increase in catalytic converter thefts lead to an increase in the cost of APD, as it is expensive to replace them. Some vehicles are more prone to thefts than others and insurers might adjust their rates accordingly. The number of catalytic converter theft claims jumped enormously in recent years, according to State Farm, with 2,500 claims in 2019 compared to 45,000 in 2022. The average claim cost increased from $1,900 in 2019 to $2,500 in 2022.

An additional recent social-related trend is the spike of theft for specific Hyundai and Kia models. In 2023, according to the National Insurance Crime Bureau (NICB) report, six out of every ten vehicles that were stolen belonged to Kia or Hyundai owners. Videos surfaced on the internet showing how to take advantage of the vehicles’ lack of engine immobilizers, a common anti-theft device that prevents a car from starting without a proper key or fob. The cost of repairing a smashed window and broken steering column on a stolen vehicle can exceed $3,000 with claims reaching $10,000 worth of repairs. Of course, stolen cars that are never recovered end up being total losses which prevent companies from saving money on salvage recoveries and in turn, increasing insurance costs.

Advance Technology and Electric Vehicles Impact on APD

Modern cars come with a lot of standard technological features such as automated driving, emergency braking, pedestrian/cyclist detection, infotainment and navigation systems and blind spot monitor sensors. Naturally, high-cost electronics are more costly to repair or replace and the availability of such electronics are prone to disruptions in the supply chain. It requires highly skilled mechanics to fix them even when the smallest accidents occur.

Electric vehicles (EVs) are becoming more popular. Some forecasts even predict that EVs will contribute to 40-50% of total car sales by 2030. However, EVs tend to increase the costs for auto owners. The repair costs for small, non-luxury EV cars are 26.6 [DT3] % higher than for non-EV models (CCC). The difference is caused by parts being more expensive than parts for vehicles with internal combustion engines. Additionally, for 50% of the EV claims that required a battery replacement, the automobile claim resulted in a total loss.

The future of the APD coverage is uncertain. Rates may become more stable as specific trend-related thefts become less frequent and inflation slows down. Conversely, more intense natural disasters may increase the frequency and costs of claims. Costs to repair electric vehicles may also continue to increase automobile market share. Insurers will need to monitor these trends that continue to impact APD to provide accurate rates for their customers.